santa clara county property tax assessor

San Jose California 95110. Frequently Asked Questions FAQs CA Code of Regulations Title 18 Chapter 1 Subchapter 3 Article 1.

Santa Clara County California Fha Va And Usda Loan Information

The Santa Clara County property tax is based on the value of your home.

. All data contained here is subject to change without notice. The assessed value of your home is generally 20 less than the market value. Some property andor parts thereof may be subject to.

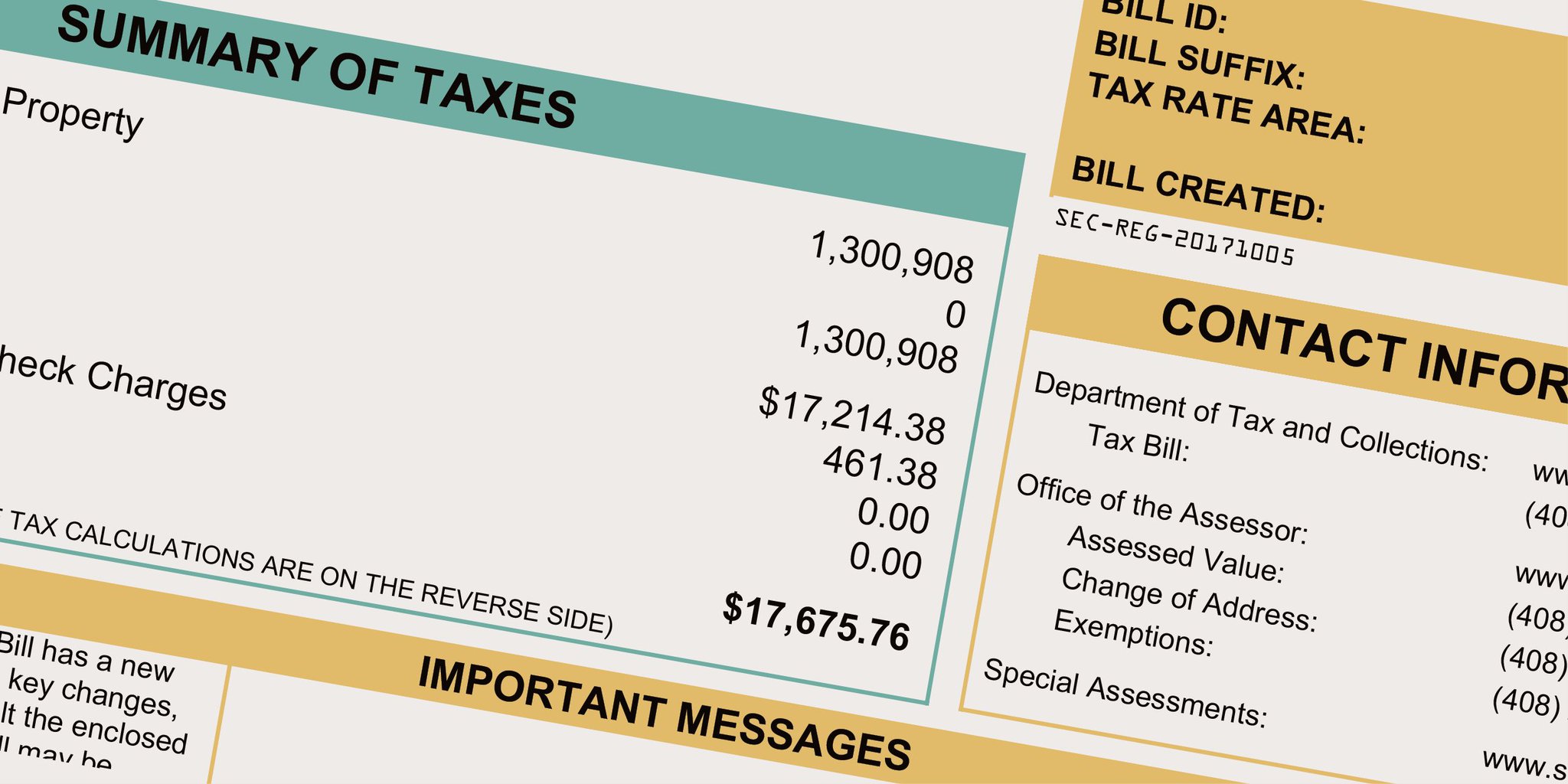

Office of the Tax Collector. The bills will be available online to be viewedpaid on the same day. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

When contacting Santa Clara County about your property taxes make sure that you are contacting the correct office. Ad Look Here For Santa Clara County Property Records - Results In Minutes. Search Santa Clara County Records Online - Results In Minutes.

CA State Tax Board of Equalization Property Tax Rules. So if your home is. San Jose CA 95110-1767.

The Santa Clara County Assessors Office located in San Jose California determines the value of all taxable property in Santa Clara County CA. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Look up and pay your property taxes online.

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Due Date for filing Business. Assessment Appeals Division 70 West Hedding Street East Wing 10th Floor San Jose CA 95110 Phone.

MondayFriday 900 am400 pm. MondayFriday 800 am 500 pm. By using this service in any form the upper agrees to.

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. County of Santa Clara COVID-19 Vaccine Information for the Public. Send us a question or make a comment.

You can call the Santa Clara County Tax Assessors Office for. The tax rate itself is limited to 1 of the total assessed property value in addition to any debts incurred by bonds approved by voters. ---- DISCLAIMER ----This search site is provided as a service to our customers.

Pay Property Taxes. Business Property Statement Filing Period. 1 2022 - May 9 2022.

The bills will be available online to be viewedpaid on the same day. Use the courtesy envelope provided and return the appropriate stub. 408 299 5500 Phone 408 297 9526 Fax The Santa Clara County Tax Assessors Office is located in San Jose California.

Taxable property includes land and commercial. Last Payment accepted at 445 pm Phone Hours. Department of Tax and Collections.

East Wing 6th Floor. The bills will be available online to be viewedpaid on the.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Assessor Tells All Employees To Telework Says It S Not Related To Employee Testing Positive For Covid 19 The Silicon Valley Voice

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Santa Clara County Al Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Bethel Vote For A New Santa Clara County Assessor San Jose Spotlight

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Property Taxes Department Of Tax And Collections County Of Santa Clara